In a defining move for the fintech landscape, UBx Philippines, the financial technology subsidiary of UnionBank of the Philippines, has appointed Dan Marogy as its new Chief Executive Officer, effective immediately.

The appointment — announced via a regulatory filing — signals a fresh strategic horizon for the fintech unit, as it positions itself at the forefront of digital transformation, financial inclusion, and the ongoing rise of tech-driven banking solutions in the country.

Leadership transition and strategic imperatives

The naming of Dan Marogy as CEO is more than a routine executive reshuffle. It reflects UBx’s ambition to accelerate growth and sharpen its focus on building next-generation financial platforms for Filipinos. As UnionBank’s fintech arm, UBx has earned recognition for its innovation-first approach, launching solutions that address long-standing gaps in financial access while experimenting with technologies that push the sector forward.

Since its inception, UBx has driven initiatives across digital lending, open finance, blockchain, and e-commerce enablement. Among its standout platforms is SeekCap, a lending marketplace that connects micro, small, and medium enterprises (MSMEs) with financing opportunities — a crucial service in a country where MSMEs make up over 99% of registered businesses but continue to face barriers in accessing capital. UBx has also partnered with startups, regulators, and ecosystem players to champion financial inclusion, consistent with UnionBank’s broader “Tech-Up Pilipinas” mission.

With Marogy at the helm, UBx appears ready to intensify these efforts. His leadership arrives at a pivotal moment: UnionBank itself is deepening its digital-first strategy after securing one of the country’s first digital banking licenses, and the fintech landscape is heating up with both local and global players vying for market share.

Dan Marogy’s experience and vision for UBx

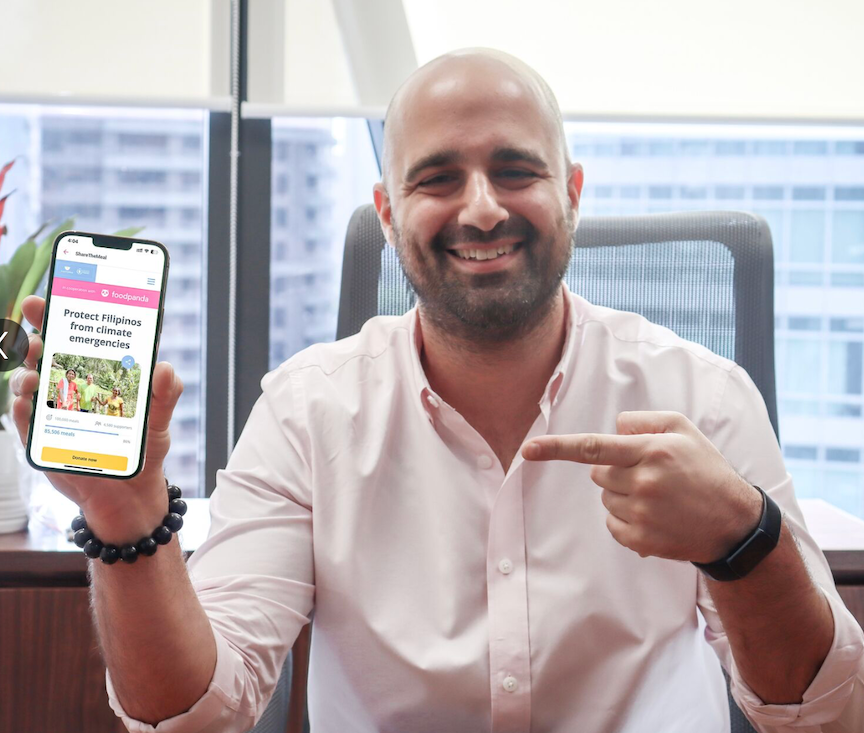

Dan Marogy brings a wealth of operational expertise and leadership acumen that could prove transformative for UBx. Most recently, he served as Managing Director of foodpanda Philippines, where he oversaw rapid expansion amid intense competition in the food delivery and logistics sector.

Under his watch, foodpanda scaled operations to reach more cities nationwide, strengthened its delivery infrastructure, and adapted quickly during pandemic disruptions.

This experience provides Marogy with a playbook highly relevant to fintech: scaling digital services in diverse and fragmented markets, responding agilely to shifting consumer behaviors, and managing large, tech-enabled workforces. These qualities are critical as UBx pushes further into embedded finance, alternative lending, and rural banking partnerships, all of which require operational depth and strategic flexibility.

Although Marogy has yet to release detailed public statements on his UBx vision, his track record hints at an emphasis on scalability, customer-centric innovation, and ecosystem collaboration. Industry observers expect him to build on UBx’s foundation by expanding its product suite, forging stronger ties with regulators, and pursuing cross-sector partnerships that integrate financial services more seamlessly into everyday life.

What this means for the future of Philippine fintech

Marogy’s appointment comes at a time when the Philippine fintech sector is undergoing rapid growth. The BSP reports that digital payments accounted for 42% of total retail transactions in 2022, up from just 1% in 2013, and projects digital payments adoption to surpass 50% in the near term. With the central bank pushing for 100% financial inclusion by 2030, fintechs like UBx are expected to play a crucial role in bridging access gaps.

UBx is well-positioned to leverage this momentum. Its platforms already cater to underserved segments such as MSMEs and unbanked individuals. With stronger leadership and UnionBank’s infrastructure backing, UBx could scale these solutions to reach millions more Filipinos, particularly in rural and remote areas where traditional banking infrastructure is limited.

At the same time, UBx is likely to double down on regulatory-aligned innovation. The BSP has been tightening rules around digital onboarding, anti-fraud measures, and open finance standards, and fintech players that align early with these frameworks stand to gain trust and first-mover advantage. Marogy’s operational discipline could be instrumental in ensuring UBx not only meets compliance requirements but also turns them into competitive differentiators.

Furthermore, the potential for embedded finance—integrating financial services directly into non-financial platforms—represents a major opportunity. With Marogy’s background in digital marketplaces and platforms, UBx may pursue more integrations across e-commerce, logistics, and lifestyle apps, positioning itself as a financial enabler across multiple industries.

UBx: Charting the next chapter of fintech-led inclusion

As UBx embarks on this new leadership era, the fintech subsidiary’s trajectory appears focused on three imperatives:

- Deepening Digital Innovation – Building scalable platforms that address real-world pain points, from MSME lending to blockchain-enabled transactions.

- Driving Inclusive Access – Expanding reach to the unbanked and underbanked, particularly in rural communities, by leveraging digital-first approaches.

- Scaling High-Impact Services – Moving beyond pilot projects to large-scale adoption, ensuring that fintech solutions deliver measurable economic and social value.

UnionBank’s support will remain a critical enabler. As one of the most digitally progressive banks in the country, UnionBank has consistently championed initiatives such as blockchain-based remittances, digital-first branches, and an open banking mindset. With UBx as its fintech engine and Marogy steering operations, the synergy between the parent bank and its subsidiary could unlock new growth trajectories.

The appointment of Dan Marogy as the CEO of UBx Philippines marks more than just a leadership transition — it is a statement of intent. UBx is signaling its readiness to move into a new growth phase where digital solutions, inclusive finance, and cross-sector collaboration converge.

With Marogy’s proven track record in scaling digital operations and UnionBank’s “Tech-Up Pilipinas” ethos, UBx is poised to play a defining role in the next chapter of Philippine fintech. For the millions of Filipinos still excluded from the financial system, and for businesses seeking smarter financial tools, UBx’s evolution under its new CEO may well shape how digital finance empowers lives and communities in the years to come.