In a dual thrust aimed at both bolstering domestic entrepreneurship and affirming international confidence, the Bangko Sentral ng Pilipinas (BSP) has launched a groundbreaking credit assessment tool for Small and Medium Enterprises (SMEs) while simultaneously welcoming the affirmation of the Philippines’ robust investment-grade credit rating.

These pivotal developments underscore the central bank’s unwavering commitment to fostering a resilient, inclusive, and globally competitive Philippine economy.

Unlocking opportunities: BSP launches SME Credit Risk database

On July 29, 2025, the BSP, in partnership with the Japan International Cooperation Agency (JICA), unveiled the Credit Risk Database Philippines Web-based Scoring System (CRDPh System). This innovative online platform is set to revolutionize how financial institutions (FIs) evaluate the creditworthiness of SMEs, a sector vital for the nation’s growth yet often underserved by traditional lending mechanisms.

The CRDPh System generates crucial credit scores and default probabilities by leveraging anonymized financial and non-financial data from participating FIs. This digital solution streamlines loan assessments, making them faster and more accessible by eliminating the need for cumbersome standalone software installations.

This initiative is particularly geared towards addressing the “missing middle“ — SMEs that are too large for microfinance but too small to meet the stringent requirements of traditional commercial banks. By providing FIs with an additional, data-driven tool for approving and pricing SME loans, the CRDPh System aims to bridge this financing gap, unlocking capital for thousands of businesses eager to expand.

Beyond direct lending, the system will also equip policymakers with valuable benchmark statistics and data, crucial for crafting targeted measures to further enhance SME financing.

Global vote of confidence: Investment-grade rating affirmed

Adding to the positive economic narrative, the BSP also welcomed the affirmation of the Philippines’ “A-” investment-grade rating with a “stable” outlook by Japanese credit watcher Rating and Investment Information, Inc. (R&I) in its report released on August 20, 2025. This prestigious rating is a clear testament to the country’s robust economic health and sound financial management.

R&I highlighted several key strengths underpinning its decision. The Philippines’ impressive 5.7 percent growth rate in 2024 stands out as one of the fastest in Southeast Asia, signaling strong economic momentum. Equally encouraging is the country’s low inflation environment, which fell to a six-year low of 0.9 percent in July 2025, reflecting the effectiveness of the BSP’s monetary policies.

The report also cited the Philippines’ strong external position, characterized by a manageable current account deficit, prudent external debt levels, and sufficient foreign exchange reserves. The sustained growth of overseas Filipino remittances further bolstered this favorable outlook.

Furthermore, the stability and resilience of the local banking sector were underscored as a key driver of the positive rating.

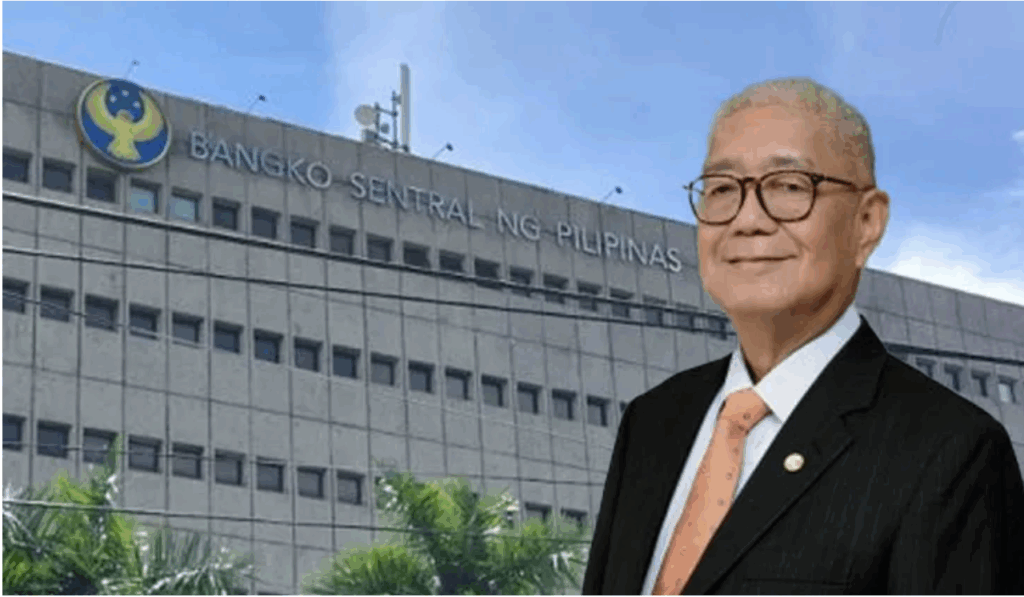

BSP Governor Eli M. Remolona, Jr., attributed the low inflation environment to the “agile and evidence-based monetary policy,” which “supports an investment climate that is conducive to economic growth.” He added, “In line with its financial stability mandate, the BSP continues to strengthen the Philippine banking system through policies that underscore strong capitalization, prudent risk management, and sound governance. These enable banks to finance productive economic activities while navigating a fast-evolving global economic landscape.”

This latest affirmation from R&I echoes the positive assessments from other leading credit rating agencies. S&P Global Ratings revised its outlook on the Philippines’ rating to positive in November 2024, while Japan Credit Rating Agency and Fitch Ratings both affirmed the country’s credit rating at “A-” and “BBB,” respectively, with a “stable” outlook in Q2 2025.

An investment-grade rating is vital as it signals low credit risk to international investors, thereby reducing borrowing costs for the government and private sector, and freeing up more funds for crucial social initiatives and development programs.

A connected and prosperous future

Together, the launch of the CRDPh System and the continued validation of the Philippines’ investment-grade credit rating paint a compelling picture of a nation actively pursuing both inclusive growth and macroeconomic stability.

By empowering SMEs with better access to finance and maintaining global investor confidence, the BSP is laying a solid foundation for a more connected, resilient, and prosperous digital Philippines.