Mocasa, the Philippines’ first virtual credit wallet, is here to help Filipinos enjoy the holiday season without breaking the bank.

With the holidays just around the corner, the virtual credit wallet knows that this season not only brings the warmth of family gatherings and vacation getaways — the Christmas season also comes with the reality of mounting expenses for the average Filipino.

From plane tickets and hotel bookings to thoughtful gifts and unexpected costs, the season’s joy can quickly get overshadowed by financial stress.

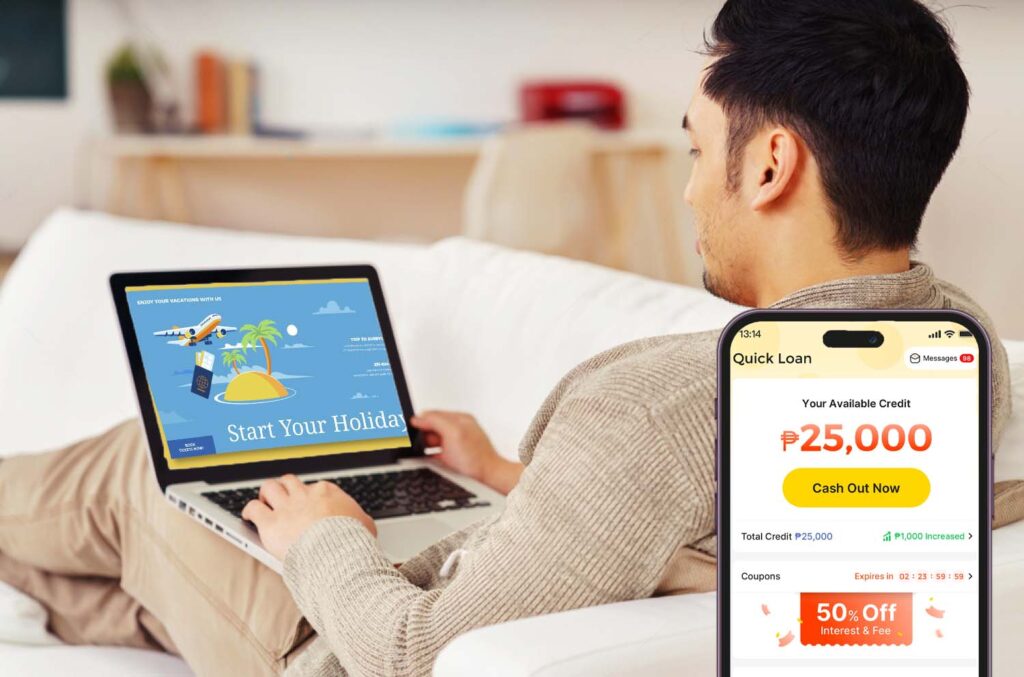

Launched in 2021, Mocasa offers a solution that feels tailor-made for this time of year to help you make the most of your travel budget: the Quick Loan feature.

Providing access to up to PHP 25,000 in credit, travellers can cover all their holiday expenses with the peace of mind they won’t be facing a hefty bill all at once. Instead, repayments are spread over three easy instalments, allowing you and your family to fully immerse in holiday festivities knowing that you have a manageable plan in place.

Mocasa offers 5 practical tips with a boost

1) Book smart and early — for those planning to go on a trip, one of the best ways to save money is by booking flights and accommodations early. However, with so many holiday expenses, finding the cash upfront to secure those “early bird” deals is not always easy.

This is where the virtual credit wallet steps in. With the Quick Loan, travellers can snag the best rates and spread the cost over time, giving them a head start on holiday plans. Imagine securing affordable travel options without the usual financial strain — a gift from Mocasa that makes holiday budgeting easier and more strategic.

2) Set a realistic travel budget — holiday travel is often about reuniting with loved ones or taking that long-awaited vacation, so it’s easy to get swept up in the excitement. However, setting a realistic budget is crucial to ensure that holiday cheer doesn’t turn into post-holiday debt. By estimating costs such as transport, food, and activities, travellers can gain clarity on what to expect.

Mocasa’s flexible loan options come in handy here, as they allow for extra funds to cover any additional expenses. No need to compromise on your holiday plans or skip out on special memories — Mocasa has you covered, providing you with the flexibility to enjoy the season while staying within your budget.

3) Be ready to handle the unexpected — even the best-planned holiday trips and activities can come with surprises — whether it’s an emergency expense, a spontaneous treat, or an opportunity to make the trip even more memorable.

Mocasa’s virtual credit wallet ensures you’re never caught off guard. With its quick access to credit, you have the security of knowing that any last-minute costs can be handled without stress. This financial freedom enables you to focus on what matters most: the joy of the holiday season, uninterrupted by unanticipated expenses.

4) Use credit wisely — while Mocasa’s Quick Loan is a convenient option, responsible borrowing is key to a happy and financially healthy holiday. Mocasa encourages users to borrow only what they can comfortably repay.

By keeping an eye on your holiday expenses and making thoughtful decisions, you can truly enjoy the benefits of a virtual wallet without carrying debt into the new year. Mocasa’s goal, after all, is to empower users, giving them the financial flexibility they need while supporting wise spending habits.

5) Make your holiday dreams come true — with Mocasa, holiday travel becomes an achievable goal, not just a seasonal dream. As businesses and families across the Philippines embrace digital financial tools, Mocasa’s virtual credit wallet is a bridge between convenience and responsibility.

By allowing users to manage both physical and digital expenses, Mocasa supports an evolving financial landscape and provides a valuable service to Filipinos. The app is already helping over 200,000 active users nationwide, and with reputable partners like Mastercard, it ensures that quality credit services are just a tap away.

This holiday season, why not let Mocasa be a part of your plans? It offers more than just financial support; it’s a companion that lets you focus on creating memories, strengthening connections, and celebrating the season fully.

With Mocasa by your side, your dream holiday is closer than ever. It also understands the unique challenges of this season and thus offers insightful tips to help Filipinos plan, save, and navigate the holidays with confidence, ensuring they enjoy the celebrations while staying on track with their financial goals.

To start your journey with Mocasa, simply download the app from Google Play or the App Store. With its easy application process, quick loan feature, and flexible repayment options, Mocasa is ready to make your holiday season stress-free and memorable.

For more updates and holiday tips, check out Mocasa on their social media pages, and let your holiday dreams take flight with the support of Mocasa’s virtual credit wallet.